Economic consequences of affluent spending contraction

What happens if the top 10% of wealth owners pull back spending by 10%? Recession.

We are all aware of the increasing wealth disparity in developed nations, most particularly the United States. Although much of the commentary is centered on social inequality, recent research from Moody's indicates that there might be serious economic consequences too.

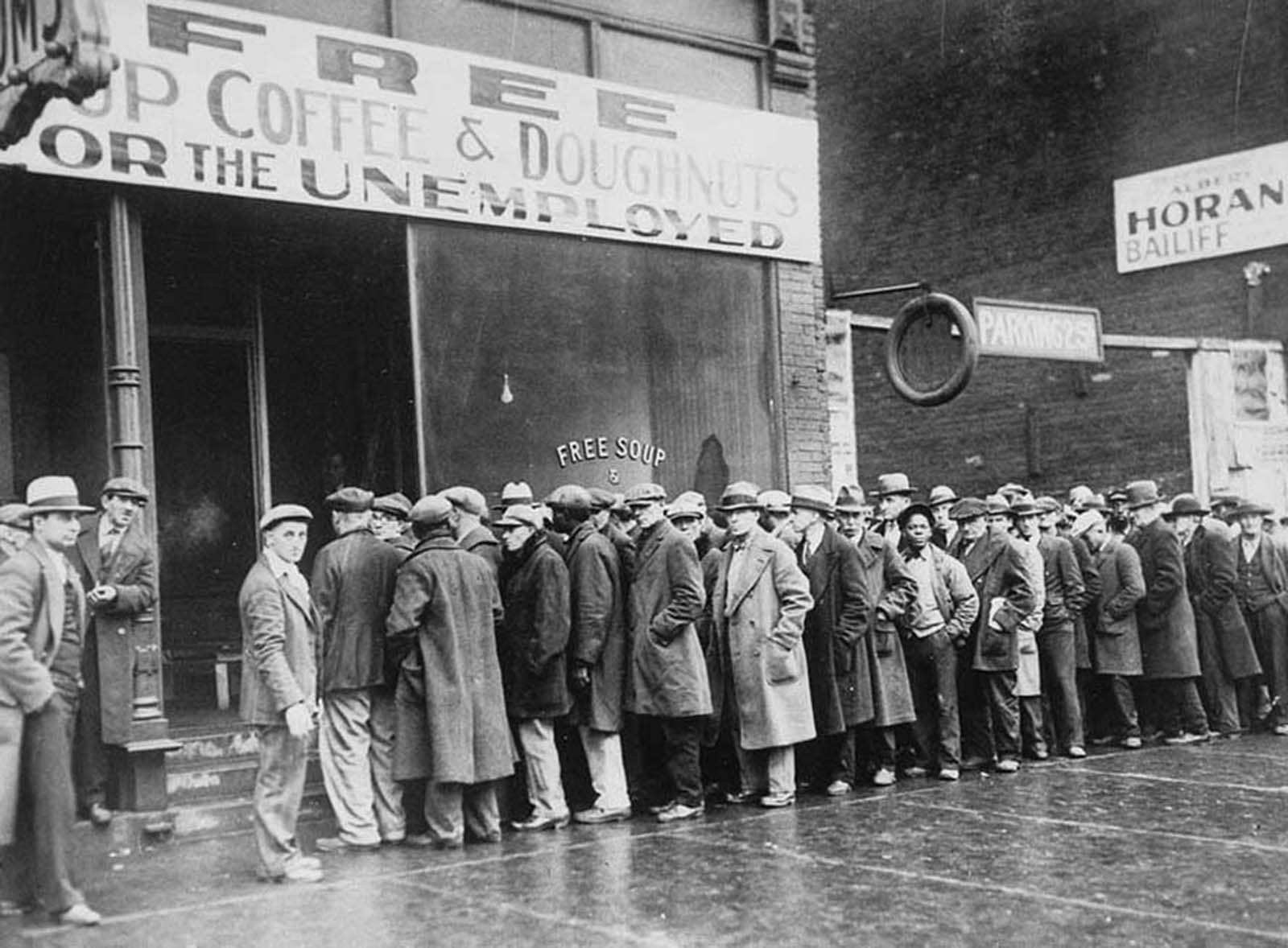

Economic downturn impact on spending

When the high-velocity dollars of the affluent slow their circulation, the ripple effects across the broader economy are both immediate and profound.

A 10% reduction in spending among the top 10% of wealth holders would trigger a 5% contraction in consumer spending (given their 50% contribution), potentially shaving 1.5% from GDP directly.

However, this first-order calculation significantly understates the full economic impact due to multiplier effects, which amplifies the initial spending reduction through successive rounds of economic activity.

The catalyst for such spending cuts is already materializing. The correction-to-bear market transition represents a direct erosion of paper wealth for this demographic, who hold approximately 89% of all equities according to Federal Reserve data.

This wealth effect that drove the past decade's economic expansion operates in reverse when asset values decline – households feel poorer and curtail discretionary spending accordingly.

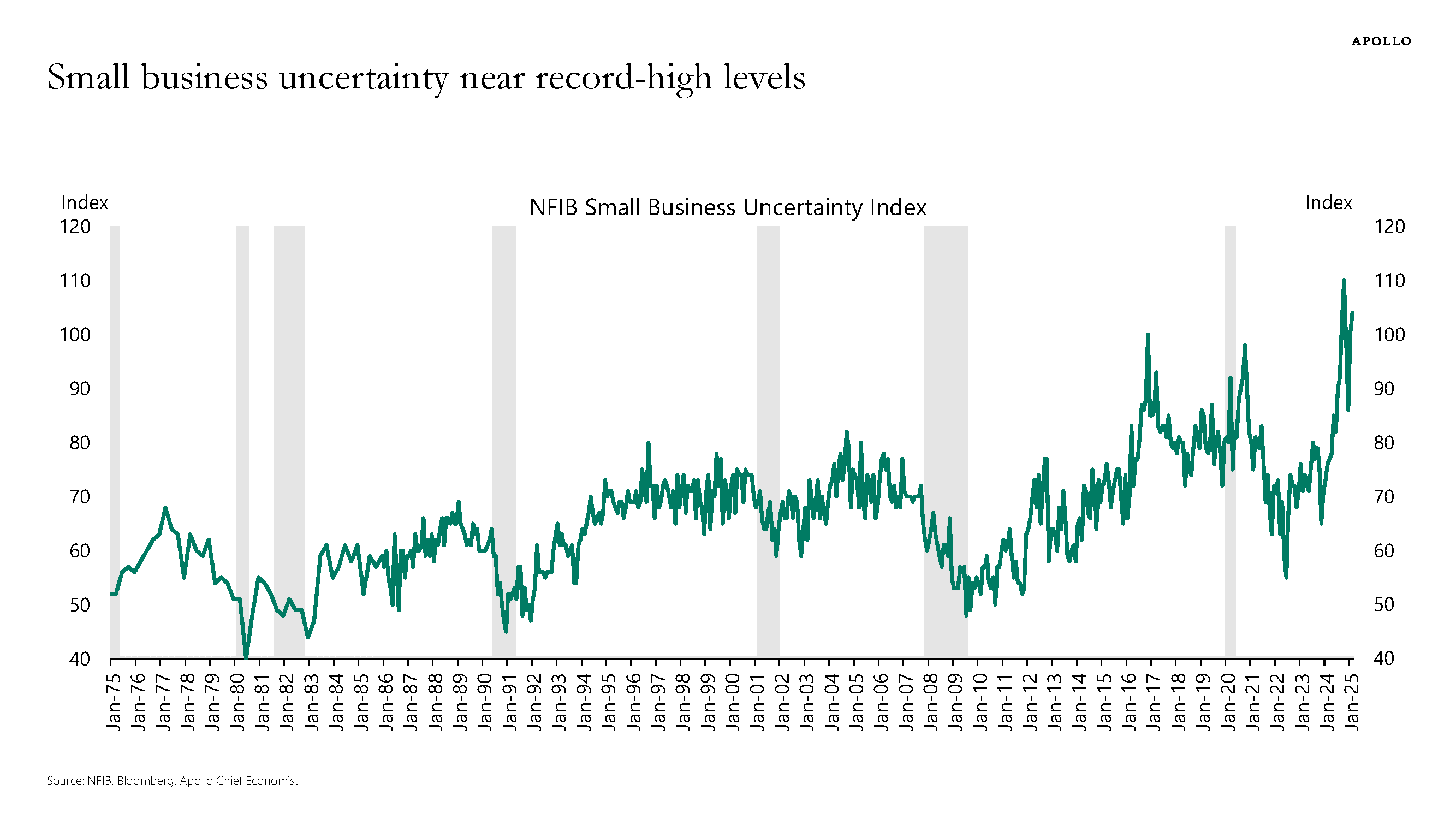

Add to this the psychological impact of deteriorating small business and consumer confidence, now at multi-year lows, and the conditions for behavioral spending shifts become acute.

The wealth effect typically produces a 3-5 cent reduction in spending for every dollar of lost wealth, meaning a 10% market decline could trigger spending reductions well beyond our initial 10% assumption.

Potential sector impact of a 10% spending pullback by the top 10%

| Sector | Impact Severity | Primary Consequence |

|---|---|---|

| Luxury goods | Severe | 15-20% revenue contraction |

| High-end real estate | Severe | Price corrections of 8-12% |

| Travel/hospitality | Moderate to severe | 10-15% revenue decline |

| Automotive | Moderate | 8-10% sales reduction in premium segments |

| Retail (mid-tier) | Moderate | 5-7% sales compression |

| Essential consumer goods | Minimal | 1-2% impact |

This spending contraction would disproportionately affect sectors serving discretionary luxury purchases, creating a cascade of second-order effects.

Update via WSJ 3/13: "Things don’t look much better on the higher end. American consumers’ spending on the luxury market, which includes high-end department stores and online platforms, fell 9.3% in February from a year earlier, worse than the 5.9% decline in January, according to Citi’s analysis of its credit-card transactions data.

Employment in luxury retail, high-end restaurants, and premium services would see immediate workforce reductions. Regional economies heavily dependent on affluent tourism and expenditure (Hamptons, Aspen, Palm Beach) would experience outsized economic contraction.

The pullback would accelerate consolidation in affected industries, with financially vulnerable companies facing existential threats as capital access simultaneously tightens.

The transmission mechanism to broader economic distress occurs through the labor market. As businesses experiencing revenue contraction implement cost-cutting measures, employment reductions spread beyond luxury sectors. This creates negative feedback loops: newly unemployed workers cut their own spending, businesses face further revenue declines, and economic contraction becomes self-reinforcing.

The economy's growth trajectory could shift from deceleration to outright contraction within 2-3 quarters, with unemployment rising 0.8-1.2 percentage points from current levels.

Thoughts about a worst case scenario

What if the top 10% of wealth holders significantly pulled back spending? Let's say by as much as 25%. This (very unlikely scenario) would fundamentally alter the economic landscape, potentially triggering a recession more severe than 2008-2009 in specific dimensions.

Assuming the same multiplier effects, this would translate to a 12.5% contraction in consumer spending and a direct 3.75% GDP reduction before accounting for amplification effects.

This magnitude of contraction would likely overwhelm the Federal Reserve's capacity to stabilize the economy through conventional monetary policy, particularly in the context of already-elevated inflation rates suggesting stagflation.

Self-reinforcing contraction

The wealth effect would become self-reinforcing as initial market declines trigger spending pullbacks, which further depress corporate earnings and prompt additional market declines.

Housing values could experience correction magnitudes of 15-20% nationally, with premium markets seeing 25-30% declines. Credit availability would contract severely across the economy as lenders respond to deteriorating conditions, further amplifying the initial spending reduction.

Most critically, this scenario would likely trigger widespread defaults in the leveraged corporate debt markets, creating systemic financial stability concerns that could necessitate extraordinary intervention measures.

We need a new middle class

The interplay between wealth concentration and economic stability represents perhaps the most significant macroeconomic vulnerability in the current system.

When the spending patterns of a narrow demographic slice exert such outsized influence on aggregate demand, the economy becomes inherently more volatile and susceptible to sentiment-driven contractions.

Ongoing economic instability could trigger the scenario discussed in this post. Consumer and business confidence data suggests we're approaching precisely such an inflection point, with leading indicators aligned for a potential expenditure pullback that could transform market corrections into broader economic distress.