When data driven is data blind and the ethnography fix

Competitive advantage belongs to those who integrate the big data and ethnography.

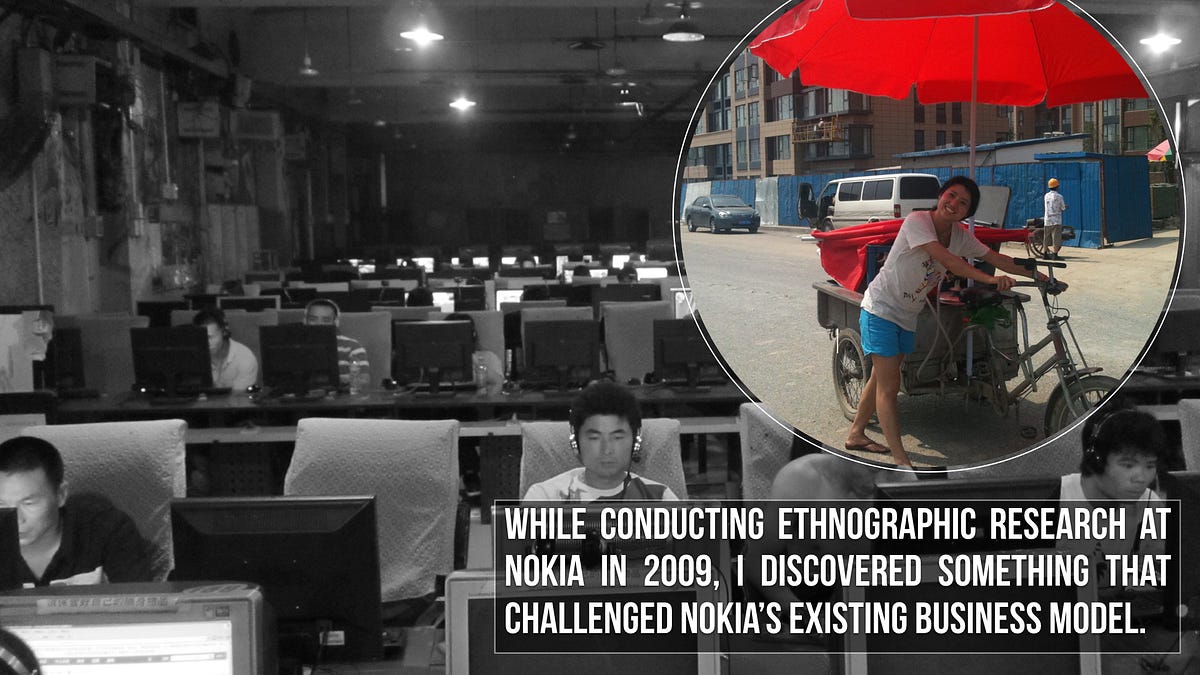

In 2009, ethnographer Tricia Wang uncovered a critical insight while conducting ethnographic (field) research in China for Nokia, then the world's dominant mobile phone manufacturer.

After extensive immersion—living with migrants, working as a street vendor, and spending time in internet cafés—Wang detected strong indicators that low-income Chinese consumers were ready to purchase more expensive smartphones.

She recommended that Nokia pivot from targeting elite users to developing affordable smartphones for mass-market adoption.

Nokia's quantitative data dependency

Nokia's leadership dismissed her findings. They cited her "small" sample size of 100 participants as insignificant compared to their millions of data points. They noted that their extensive quantitative datasets showed no evidence supporting Wang's conclusions.

In response, Wang argued that their fixed quantitative demand models couldn't capture the cultural dynamics driving consumer behavior in China—a critical distinction that "what is measurable isn't the same as what is valuable."

By 2013, Nokia was acquired by Microsoft and held just 3% of the global smartphone market. While multiple factors contributed to this collapse, Wang witnessed firsthand how over-reliance on quantitative data prevented Nokia from recognizing transformative market signals that didn't fit their existing measurement frameworks.

Thick Data v. Big Data: A critical integration

In a Medium post from 2016, Wang introduced a concept she called "Thick Data" (borrowing from anthropologist Clifford Geertz's concept of "thick description") as the qualitative complement to big data.

Thick data

- Reveals emotions, stories, and mental models through ethnographic methods

- Provides profound depth with smaller sample sizes

- Generates human-centered insights through contextual understanding

- Accepts irreducible complexity in human behavior

- Produces inspiration through storytelling

Big data

- Utilizes large-scale quantitative datasets through advanced technologies

- Strips context to enable analysis through normalization and standardization

- Employs machine learning to identify patterns at scale

- Isolates variables to discover correlations

- Loses resolution while gaining scale

Wang argues that organizations achieve comprehensive understanding only when integrating both approaches. While big data reveals broad patterns across millions of data points, thick data provides the essential context to interpret those patterns meaningfully.

Without this integration of methodologies, companies risk optimizing for metrics derived from algorithms while forgetting the actual human experiences driving consumer behavior.

Strategic applications beyond consumer research

The integration of "Thick" and "Big" data offers transformative potential across multiple domains:

- Market exploration: Thick data excels at mapping unknown territory and revealing unexpected opportunities that quantitative approaches might miss entirely. This is true for big and small brands alike.

- Stakeholder relationships: Numbers alone cannot easily replicate emotions like trust, fear, security, and love that drive human relationships. Thick data reaches the emotional core that algorithms cannot access.

- Organizational change management: Quantitative data may indicate necessary changes, but Wang's thick data concepts reveal how to implement them without destructive disruption.

The Executive Imperative

For leaders operating in volatile, uncertain, complex, ambiguous (VUCA) environments, the Nokia case study offers a stark warning: quantitative excellence without qualitative depth creates dangerous blind spots.

The most significant market opportunities often emerge first as weak signals that traditional metrics will miss entirely. Much like the "soft data" such as consumer sentiment takes time to emerge in the "hard data" that typically moves markets.

Business executives must consider:

- How qualitative research can challenge and contextualize their quantitative metrics

- Whether their organization overvalues measurability at the expense of valuable insights

- How to develop processes that integrate "small n" ethnographic research with "big N" data analytics

In today's complex VUDA environment, competitive advantage increasingly belongs to organizations that can integrate the scale of big data with the human understanding of thick data. Fortunately, it's easy to achieve for those willing to consider the weight of ethnographic research.

The companies that master this integration will see around corners where purely quantitative approaches remain blind.